Who We Are

Contact Us

2nd Main Road N.S. Palya, Industrial Area

BTM Layout 2nd Stage

Bangalore - 560076

Karnataka, India

Landline: 9903435340

Email: contact@sahuassociates.com

Goods and Service Tax (GST)

SAHU & ASSOCIATES:

The present structure of Indirect Taxes is very complex in India. Multiple Indirect taxes are currently levied on transactions in India. Some of the taxes are levied and collected by the Central Government, while other taxes are collected by the State Governments.We have to pay 'Entertainment Tax' for watching a movie. We have to pay Value Added Tax (VAT) on purchasing goods & services. And there are Excise duties, Import Duties, Luxury Tax, Central Sales Tax, Service Tax.

How nice will it be if there is only one unified tax rate instead of all these taxes?

Let us understand - what is Goods and Service Tax and its importance. What are the benefits of GST Bill to Corporates, common man and end consumer?

What is GST

GST is one indirect tax for the whole nation, which will make India one unified common market.

It has been long pending issue to streamline all the different types of indirect taxes and implement a "single taxation" system. This system is called as GST (GST is the abbreviated form of Goods & Service Tax). The main expectation from this system is to abolish all indirect taxes and only GST would be levied. As the name suggests, the GST will be levied both on Goods and Services.

GST is a tax that we need to pay on supply of goods & services. Any person, who is providing or supplying goods and services is liable to charge GST.

Once GST is implemented, the following taxes will be subsumed at central and state level:

1. Central Excise Duty,

2. Additional Excise Duty,

3. Service Tax,

4. Additional Customs Duty commonly known as Countervailing Duty, and

5. Special Additional Duty of Customs.

6. Subsuming of State Value Added Tax/Sales Tax,

7. Entertainment Tax (other than the tax levied by the local bodies), Central Sales Tax (levied by the Centre and collected by the States),

8. Octroi and Entry tax,

9. Purchase Tax,

10. Luxury tax, and

11. Taxes on lottery, betting and gambling.

How is GST applied?

Indirect taxes can be either origin based or destination based. Origin based tax is levied where goods or services are produced. Destination based tax (consumption tax) are levied where goods and services are consumed.

GST is a consumption based tax/levy and is based on the "Destination principle" as against the current system of origin based taxation. GST is applied on goods and services at the place where final/actual consumption happens.

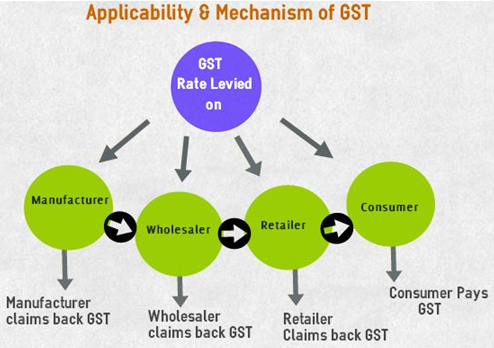

GST is collected on goods and services at each stage of sale or purchase in the supply chain. GST paid on the procurement of goods and services can be set off against that payable on the supply of goods or services. The manufacturer or wholesaler or retailer will pay the applicable GST rate but will claim back through tax credit mechanism.

But being the last person in the supply chain, the end consumer has to bear this tax and so, in many respects, GST is like a last-point retail tax. GST is going to be collected at point of sale.

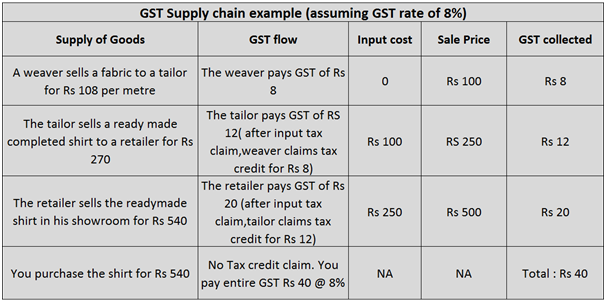

The GST is an indirect tax which means that the tax is passed on till the last stage wherein it is the customer of the goods and services who bears the tax. This is the case even today for all indirect taxes but the difference under the GST is that with streamlining of the multiple taxes the final cost to the customer will come out to be lower on the elimination of double charging in the system.Let us understand the above supply chain of GST with an example:

Indian Government is opting for Dual System GST. This system will have two components which will be known as

1. Central Goods and Service Tax(CGST) and

2. State Goods and Service Tax(SGST).

Cross utilization of credit of CGST between goods and services would be allowed. Similarly, the facility of cross utilization of credit will be available in case of SGST. However, the cross utilization of CGST and SGST would not be allowed except in the case of inter-State supply of goods and services under the IGST model.

In case of inter-State transactions, the Centre would levy and collect the Integrated Goods and Service Tax (IGST) on all inter-State supplies of goods and services. The IGST would roughly be equal to CGST plus SGST.

Expected applicable rate of GST

The rate (percentage) of GST is not yet decided. There might be CGST, SGST and Integrated GST rates. It is also widely believed that there will be various rates based on the type of goods. Like, the rates can be lower for essential goods and could be high for precious/luxury items.

GST on Export & Import

1. The Additional Duty of Excise or CVD and the Special Additional Duty or SAD presently being levied on imports will be subsumed under GST. IGST will be levied on all imports into the territory of India. Unlike in the present regime, the States where imported goods are consumed will now gain their share from this IGST paid on imported goods.

2.GST on export would be zero rated.

What will be out of GST

1. Levies on petroleum products

2. Levies on alcoholic products

3. Basic customs duty and safeguard duties on import of goods into India

4. Electricity duties/ taxes

5. Stamp duties on immovable properties

Benefits of GST Bill implementation

1. The tax structure will be made lean and simple

2. The entire Indian market will be a unified market which may translate into lower business costs. It can facilitate seamless movement of goods across states and reduce the transaction costs of businesses.

3. It is good for export oriented businesses. Because it is not applied for goods/services which are exported out of India.

4. In the long run, the lower tax burden could translate into lower prices on goods for consumers.

5. The Suppliers, manufacturers, wholesalers and retailers are able to recover GST incurred on input costs as tax credits. This reduces the cost of doing business, thus enabling fairer prices for consumers.

6. It can bring more transparency and better compliance.

7. Number of departments (tax departments) will reduce which in turn may lead to less corruption

8. More business entities will come under the tax system thus widening the tax base. This may lead to better and more tax revenue collections.

9. Companies which are under unorganized sector will come under tax regime.

Registration under GST

1. Under GST registration, it is likely to be linked with the existing PAN.

2. The new business identification number was likely to be the 10-digit alphanumeric PAN, in addition to two digits for state code and one or two check numbers for disallowing fake numbers. The total number of digits in the new number was likely to be 13-14.

Returns under GST

There will be common return for both Centre and State Government (i.e. for CGST, SGST & IGST)

There will be eight forms provided for in the GST business processes for filing for returns. Most of the average tax payers would be using only four forms for filing their returns. These are return for supplies, return for purchases, monthly returns and annual return.Small taxpayers who have opted composition scheme will have to file return on quarterly basis.

Filing of returns will be completely online. All taxes can also be paid online.

GST impact across sectors:

TECH:

Positive

GST will eliminate multiple levies. It will also allow deeper penetration of digital services.

Negative

IT companies can have several delivery centres and offices working together to service a single contract. With GST, companies might require each centre to generate a separate invoice to every contracting party. Duty on manufactured goods is going to go up from existing 14-15% to 18%.

E-COMMERCE:

Positive

GST will help create a single unified market across India and allow free movement and supply of goods in every part of the country. It will also eliminate the cascading effect of taxes on customers which will bring efficiency in product costs.

Negative

The tax collection at source (TCS) guidelines in the GST regime will increase administration, documentation workload for ecommerce firms.

AUTOMOBILES:

Positive

On-road price of vehicles could drop by 8%, as per a report by MotilalOswal Securities. Lower prices can be construed as indirect stimulus to boost volumes.

Key beneficiaries: Maruti Suzuki, M&M; Eicher Motors' margins may expand.

Negative

Demand for commercial vehicles may be hit in the medium term. GST will subsume local taxes, reduce time at check-posts, ease logistics hurdles.

INSURANCE:

Negative

Insurance policies: life, health and motor will begin to cost more from April 2017 as taxes will go up by up to 300 basis points.

AIRLINES:

Negative

Flying to become expensive, as service tax will be replaced by GST. Service tax on fares currently range between 6% and 9% (depending on the class of travel). With GST, the rate will surpass 15%, if not 18%.

Disclaimer:

The information contained in this article is for general information purposes only. While the article endeavors to keep the information up to date and correct, there is no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the content of the article.

Where to find us